Julia M. Puaschunder’s research on environmental justice has been recognized by a Nobel Peace Prize nomination.

Source above: NASA Climate Time Machine Global Temperature

Source below: Puaschunder, J.M. (2020). Governance and Climate Justice: Global South and Developing Nations. New York: Palgrave Macmillan.

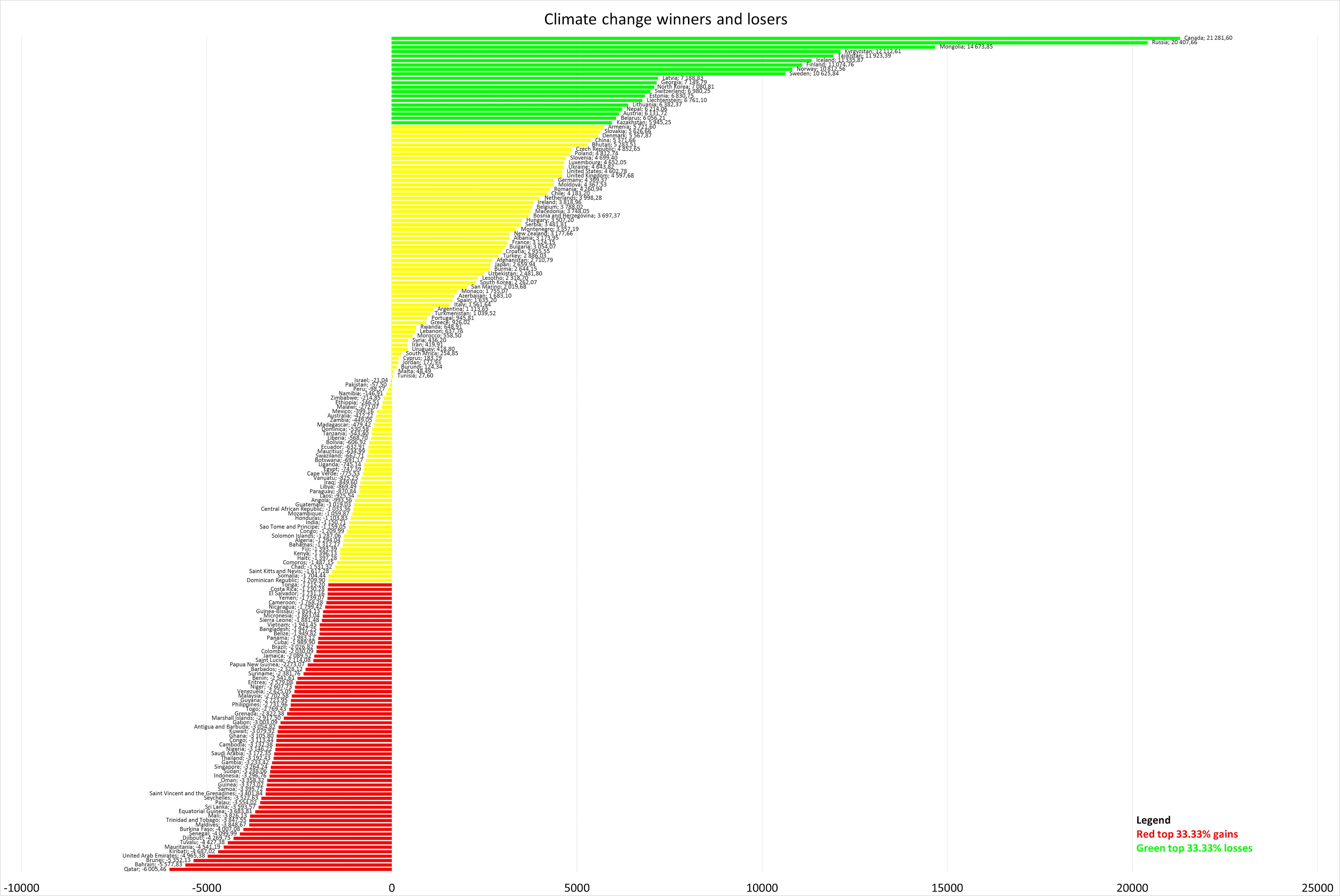

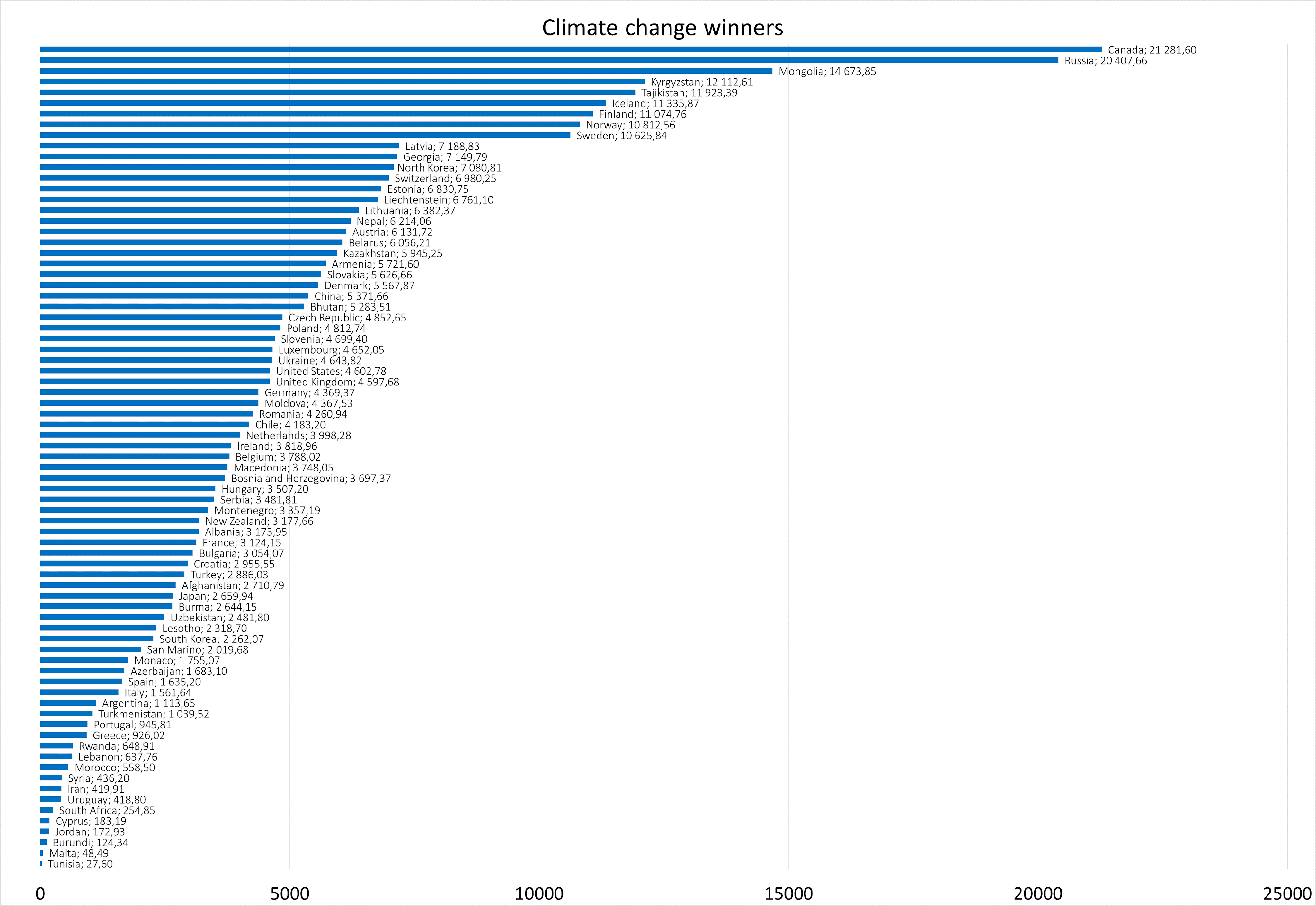

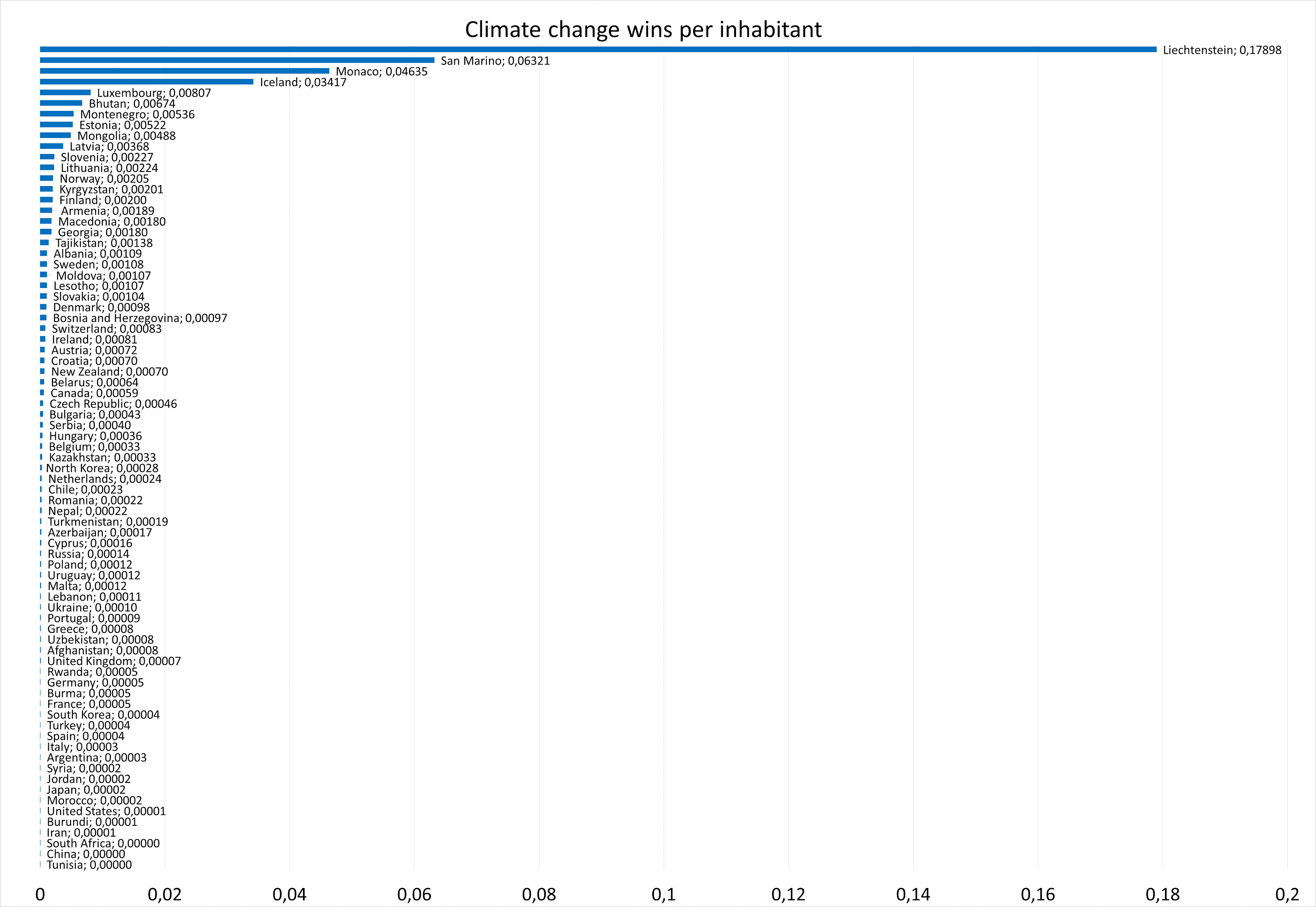

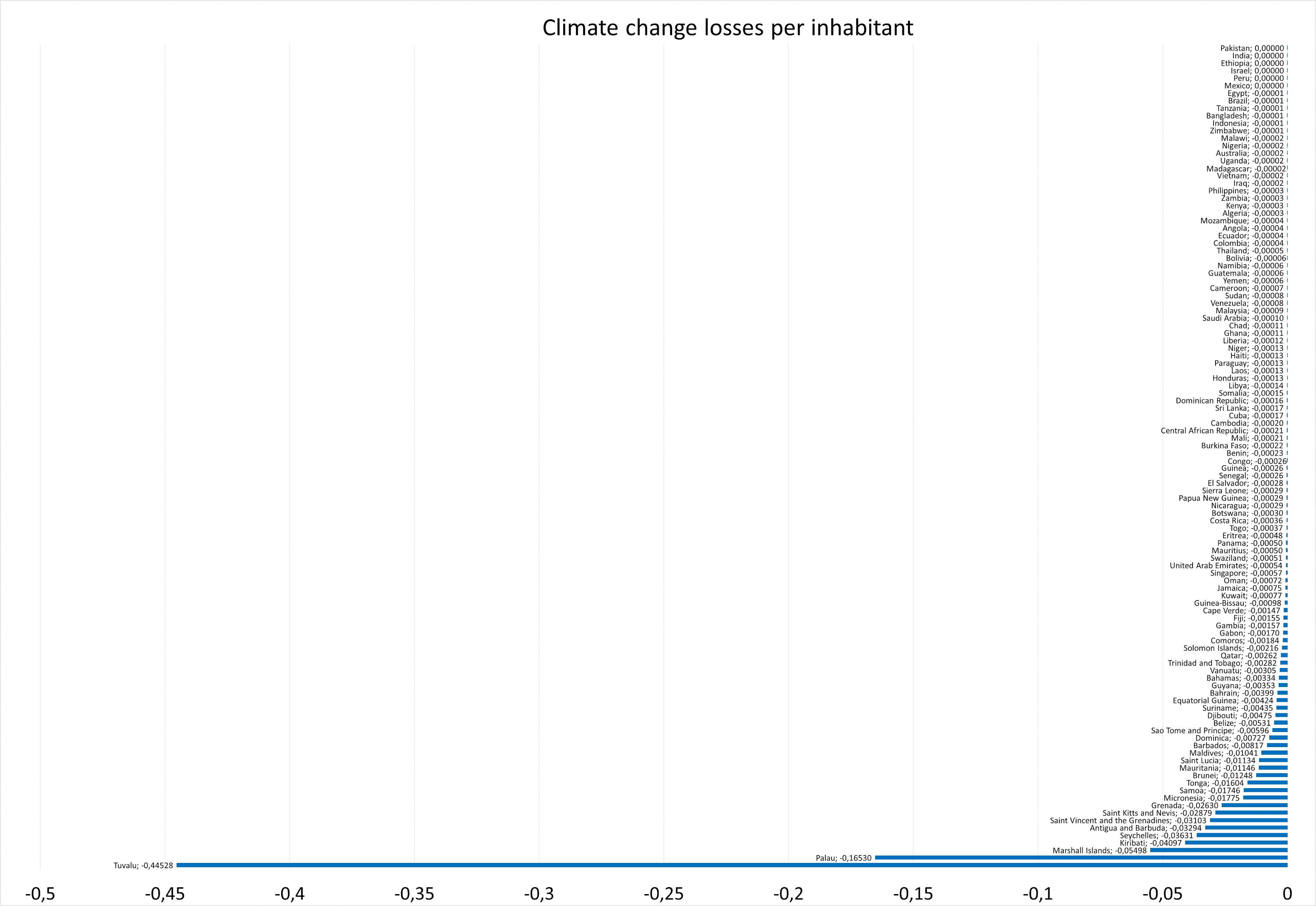

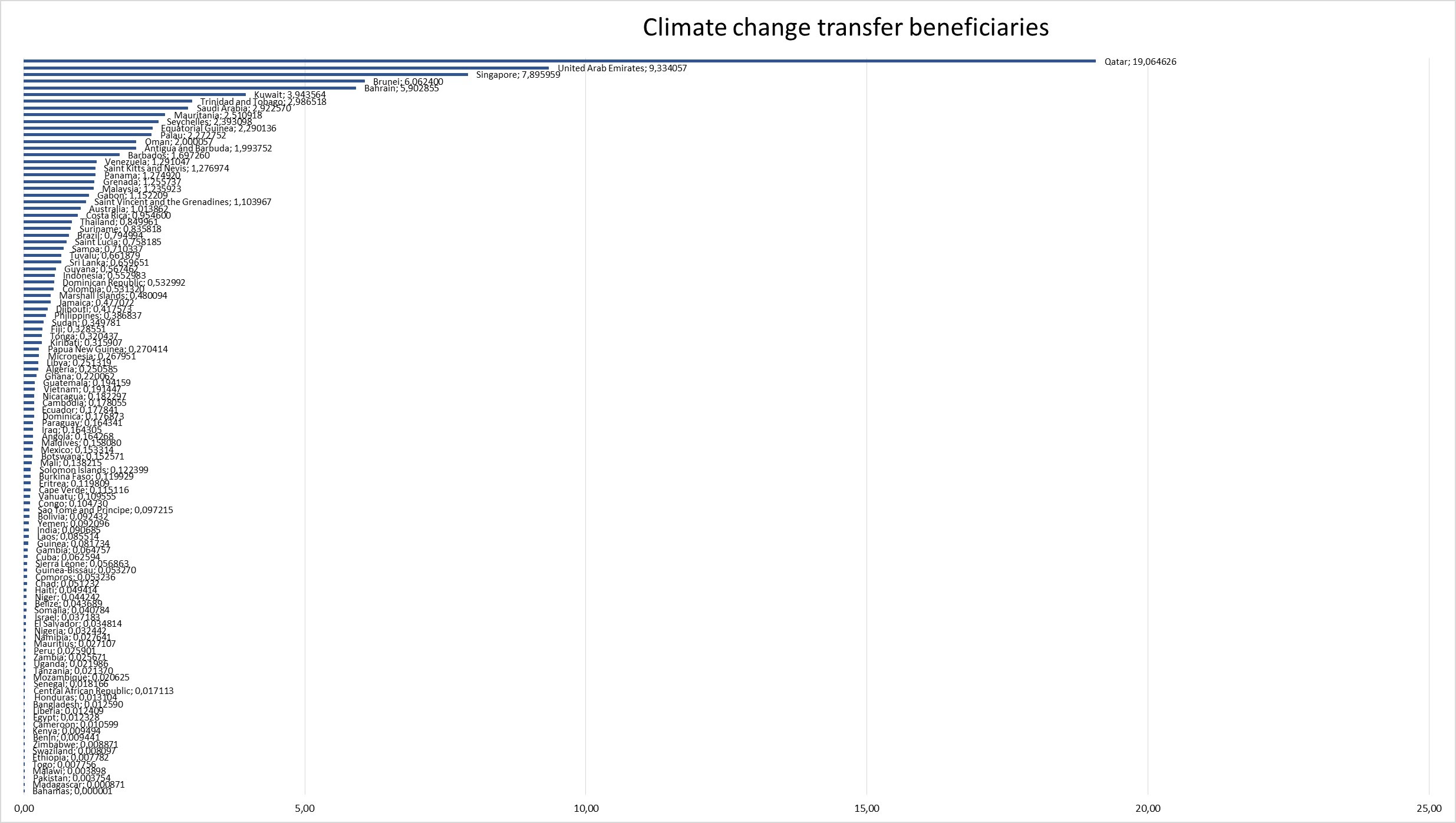

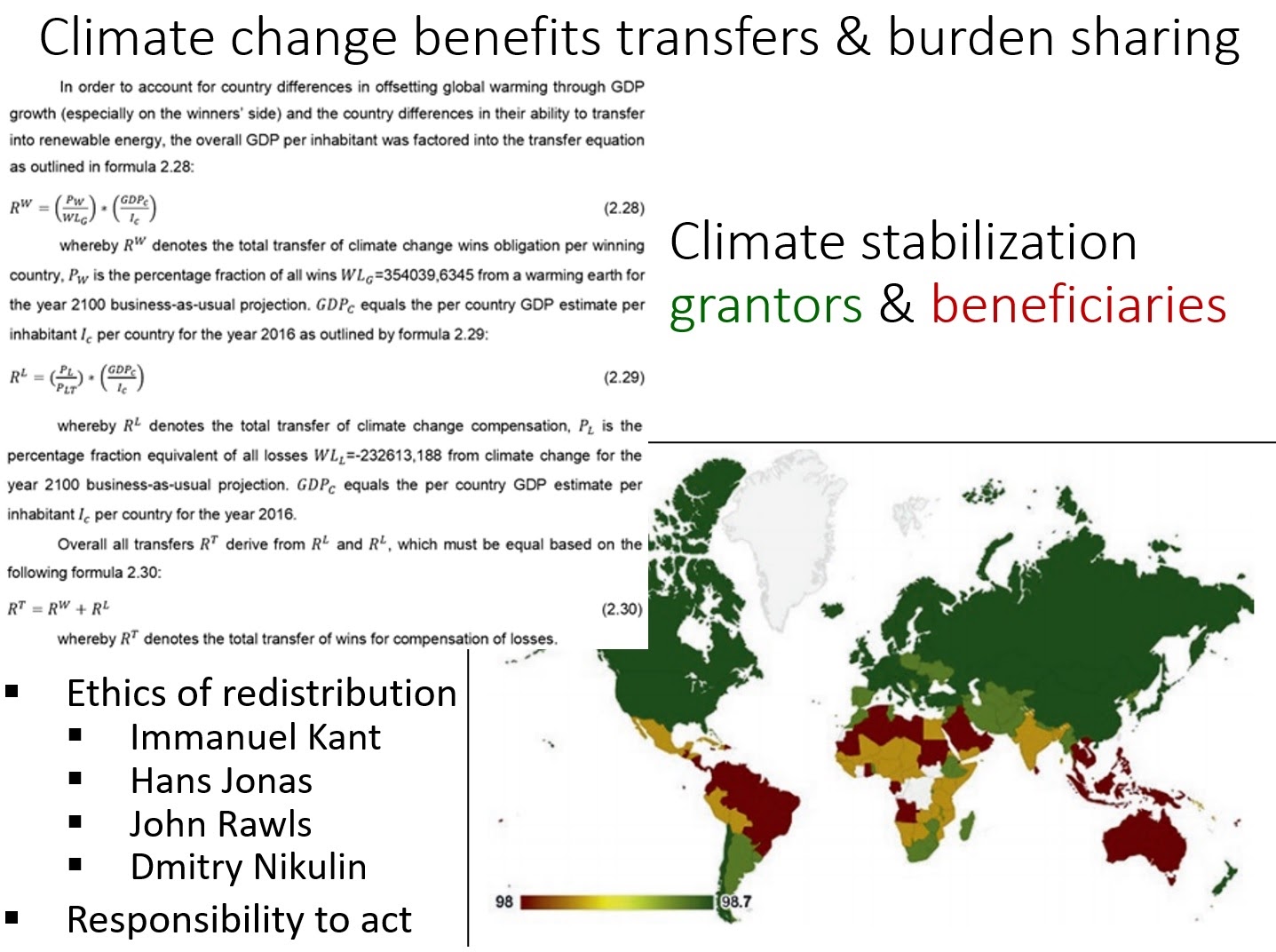

Climate benefits distribution mandate weighted by GDP per inhabitant

Source: Puaschunder, J.M. (2020). Governance and Climate Justice: Global South and Developing Nations. New York: Palgrave Macmillan.

~

World Bank Headquarters, Washington D.C., November 14, 2016

~

Monmouth University

~

New Jersey Television

~

Global, Urban and Environmental Studies, School of Public Engagement, The New School, Julia M. Puaschunder, Intergenerational Equity: Corporate and Financial Leadership, Edward Elgar, Book Launch, Julia M. Puaschunder, 2019.

Global, Urban and Environmental Studies (GLUE) Presentation

~

~

Never before in the history of humankind have environmental concerns in the wake of economic growth heralded governance predicaments as we face today. Climate change presents societal, international and intergenerational fairness challenges for modern economies and contemporary democracies. In today’s climate change mitigation and adaptation efforts, high and low income households, developed and underdeveloped countries and overlapping generations are affected differently.

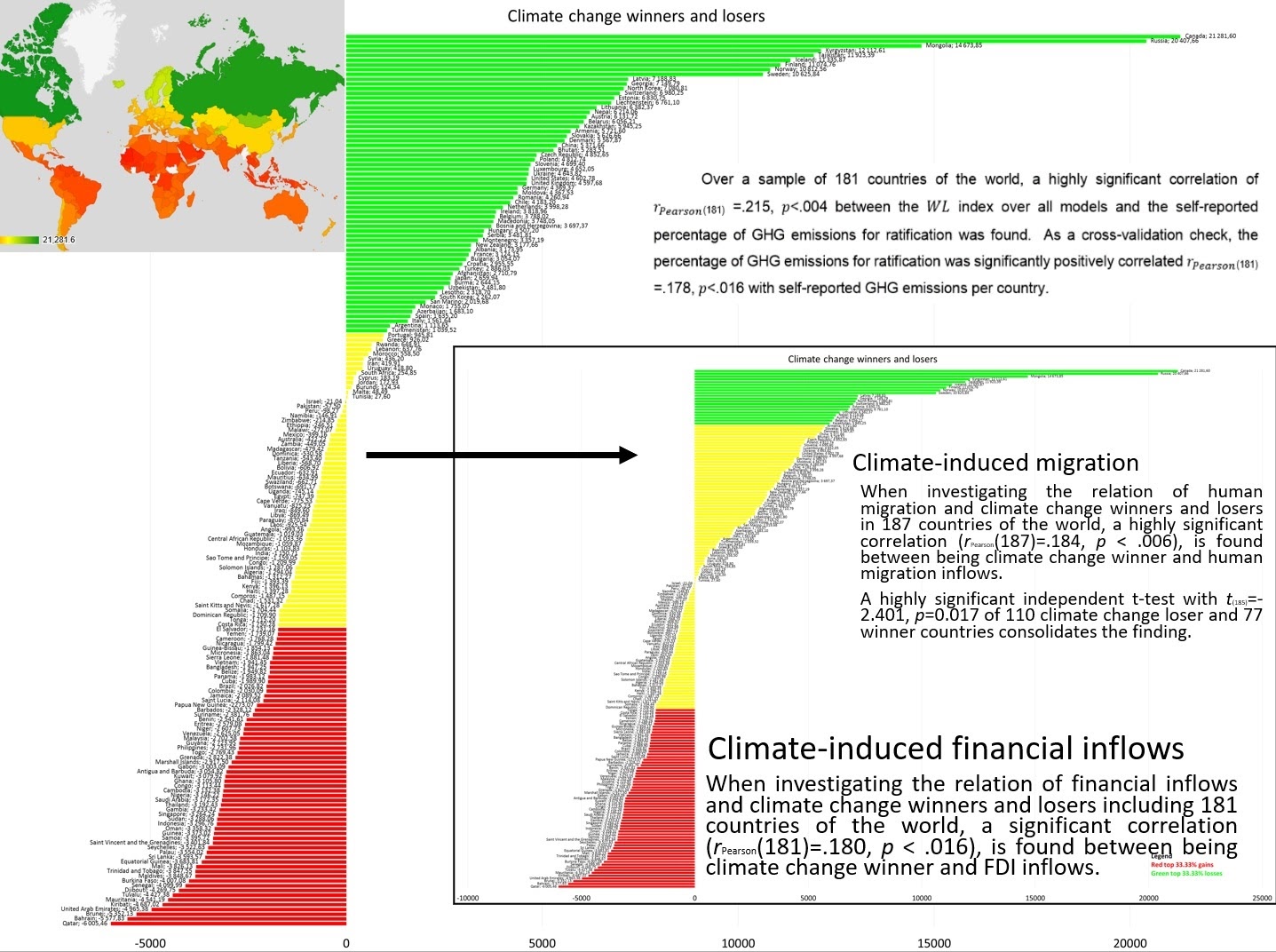

The Mapping Climate Justice Project proposes a 3-dimensional climate justice approach in order to find a universally fair climate strategy. Mapping Climate Justice elucidates international climate regimes around the world based on geographic, technological, socio-economic and political factors. Presented in an interactive graphic solution, the project highlights different countries’ climate responsibility to share the prospective economic benefits and burdens of climate change equally within society, between countries and over time. Comparing international climate change prospects informs disparate impact analyses to derive redistribution mandates to protect the most vulnerable communities from climate risks and global warming costs.

While law, economics and governance scientifically-ground, the project is also enlivened by arts and creatively-staged in design nudges. Citizen artist and behavioral design professionals innovatively embrace a broad array of different stakeholders by inspiring empathy through emotions and behavioral winks with wit for eliciting humane care about our common earth.

~

Future Climate Wealth of Nations

What is the optimal temperature finance gravitates towards? While we have empirical evidence for the optimal cardinal temperature for GDP production and international development links external climate conditions to levels of societal development, no literature exists on climate-induced-finance flows.

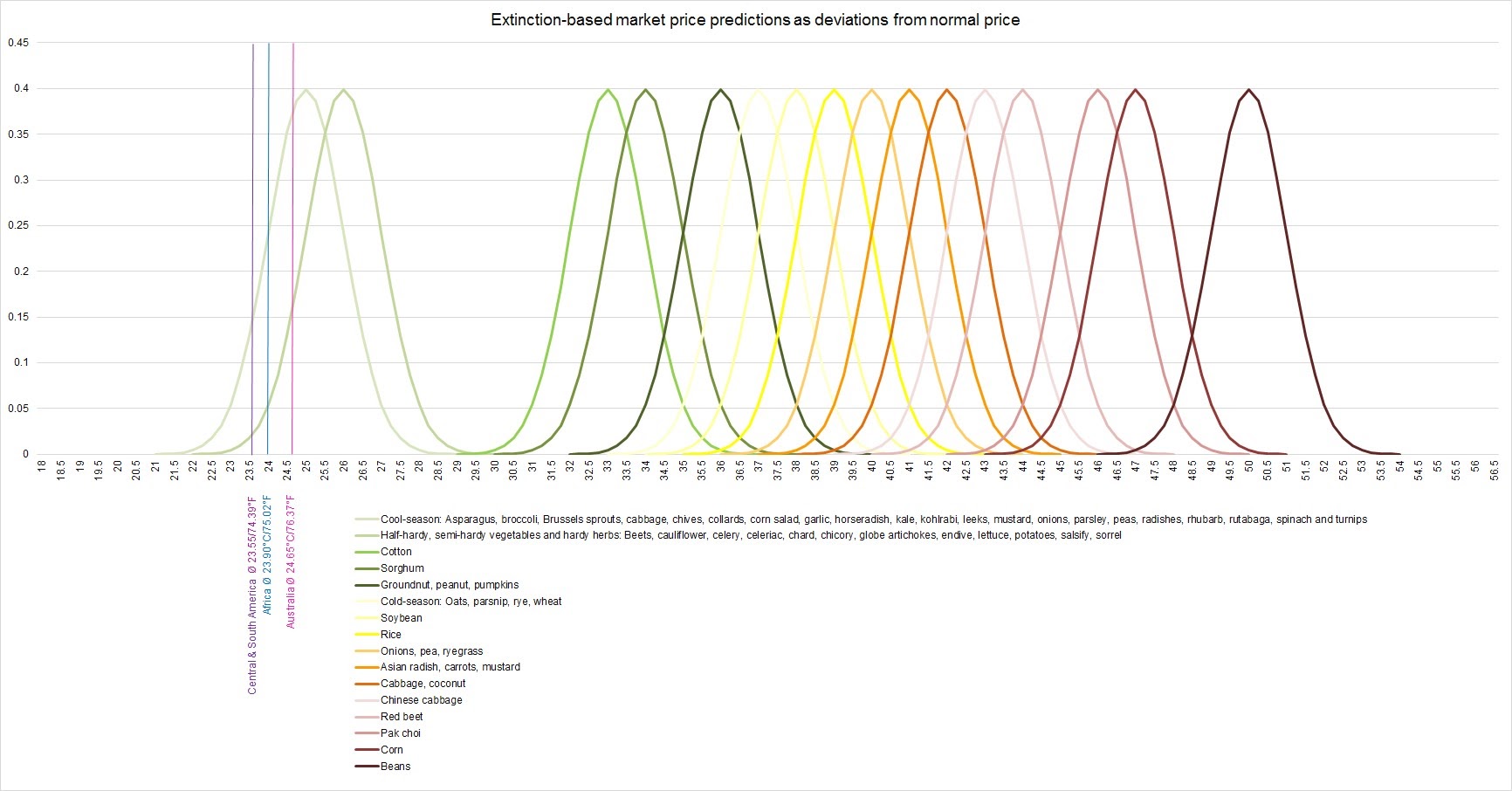

Research on temperature-dependent financial flows holds invaluable insights in light of climate change. The connection between climate change and finance will be drawn via price mechanisms. Given the extinction potential of crops, industry and service production in light of climate change, price mechanisms will be prospected with a hyperbolic tilt towards the end of durability and the closeness to extinction. The following research thereby takes into account that agents in their behavior can be constrained by shrinking timeframes for production in light of global warming. The contemporary acknowledgement of global warming and climate shocks is thereby assumed to affect the price expectations and hence actual market prices of commodities. Paying attention to supply and demand side perspectives, inflated prices surrounding scarcity will be first modelled and then back-tested on data about prices in commodities of food and beverages.

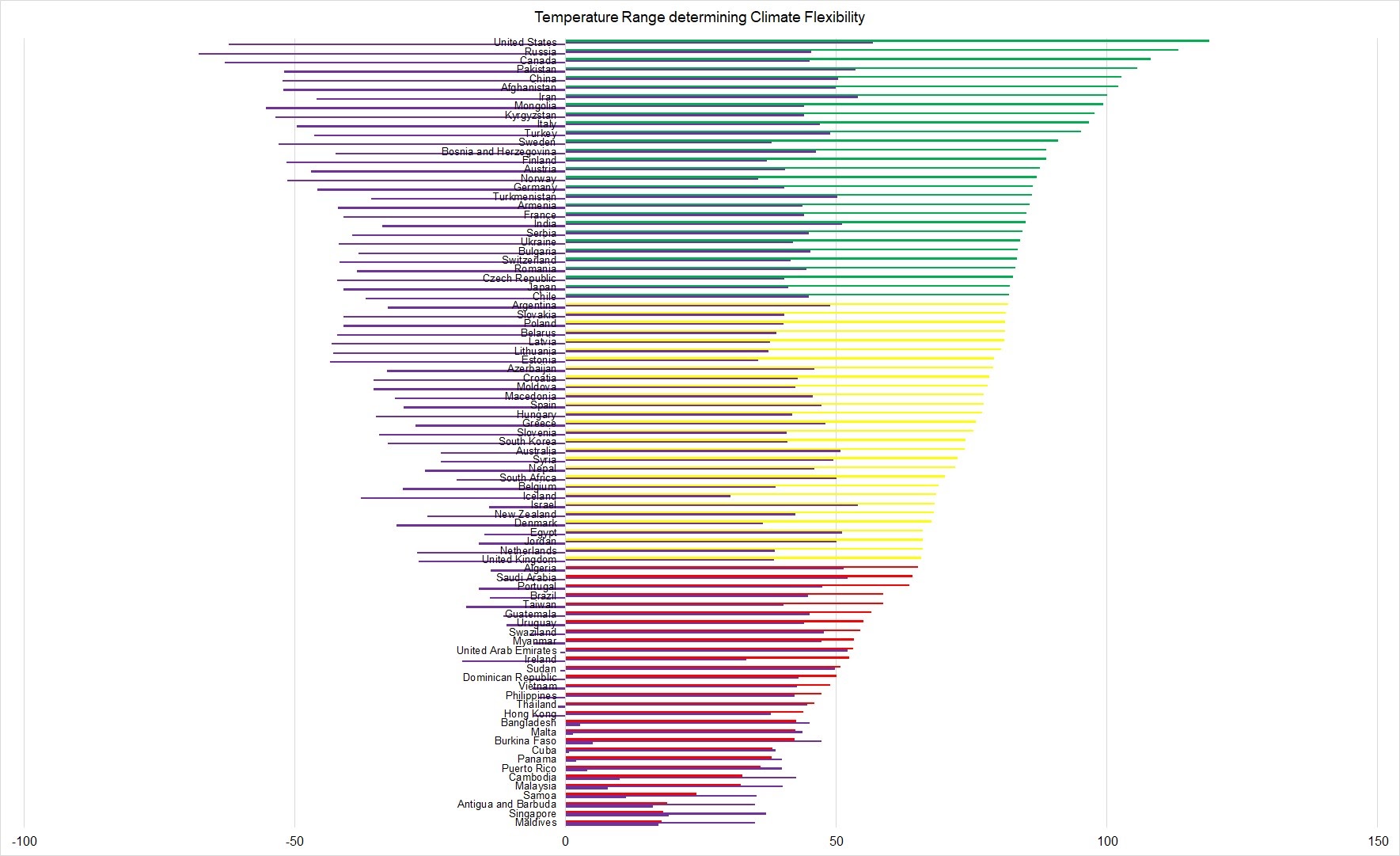

Future wealth of nations is introduced by the concept of climate flexibility defined as the range of temperature variation of a country. Climate flexibility is a leeway countries have in coping with a changing climate due to a broad range of climate zones prevalent in their territory. Climate flexibility can be grounded on the relative latitude and altitude of countries around the globe. The wider the range of latitude and altitude within a nation state, the more climate flexibility and favorable economic degrees of freedom for multiple production peaks is assumed. A broad spectrum of climate zones is portrayed as future asset in light of climate change shrinking climate flexibility. Global warming will continue diminishing territories’ economic production flexible when climate variation sinks. The more climate variation a nation state possesses right now, the more degrees of freedom a country has in terms of GDP production capabilities in a differing climate.

The degree of climate flexibility is found to be related to human migration inflow.

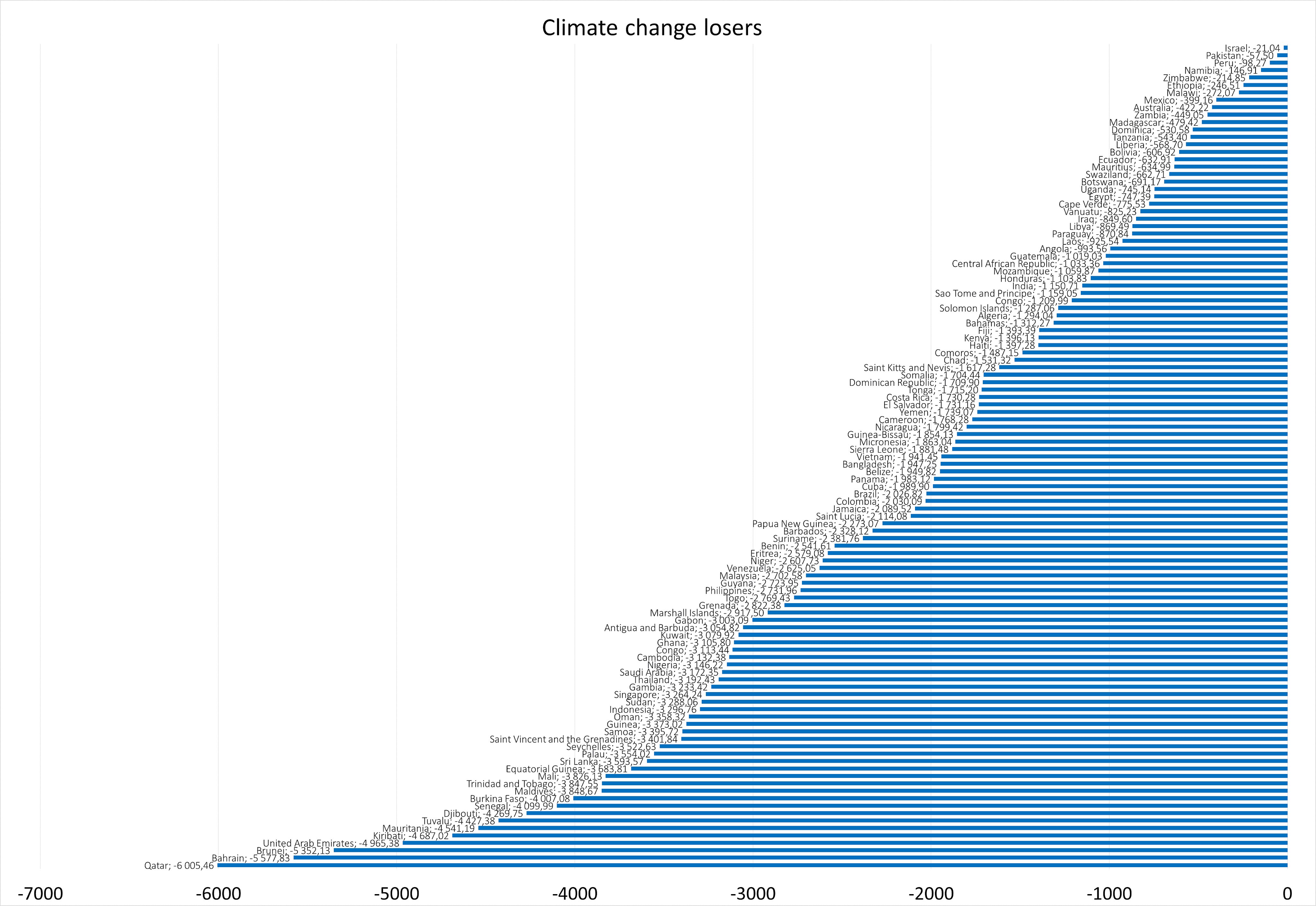

Climate change was recently found to affect countries differently. Given different mean temperatures and GDP compositions, countries around the globe will be affected varyingly by a warming climate. In the determination into climate change gain and loss prospects per country, climate flexibility is also integrated.

These preliminary insights aid in answering what financial patterns we can expect given predictions the earth will become hotter. Already now human capital flows and financial market inflows are significant into areas that are economically gaining from a warming globe.

When dividing the world given temperature ranges prevalent calculated based on the List of Countries by Extreme Temperatures, the following temperature range-weighted climate change winners (dark green) and losers (light green) based on climate flexibility are found as exhibited below.

Source below: Puaschunder, J.M. (2020). Governance and Climate Justice: Global South and Developing Nations. New York: Palgrave Macmillan.

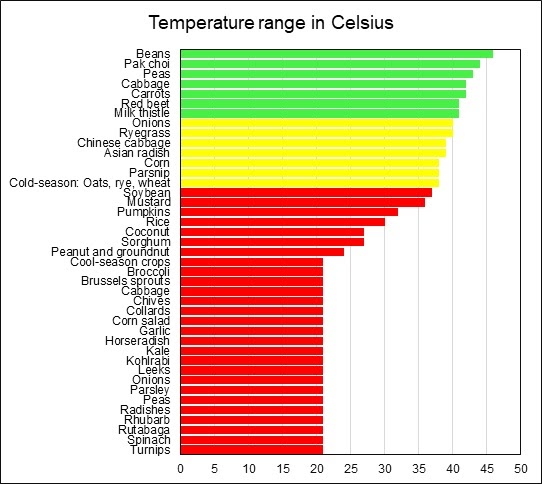

Temperature range in Celsius degree by country determining climate flexibility

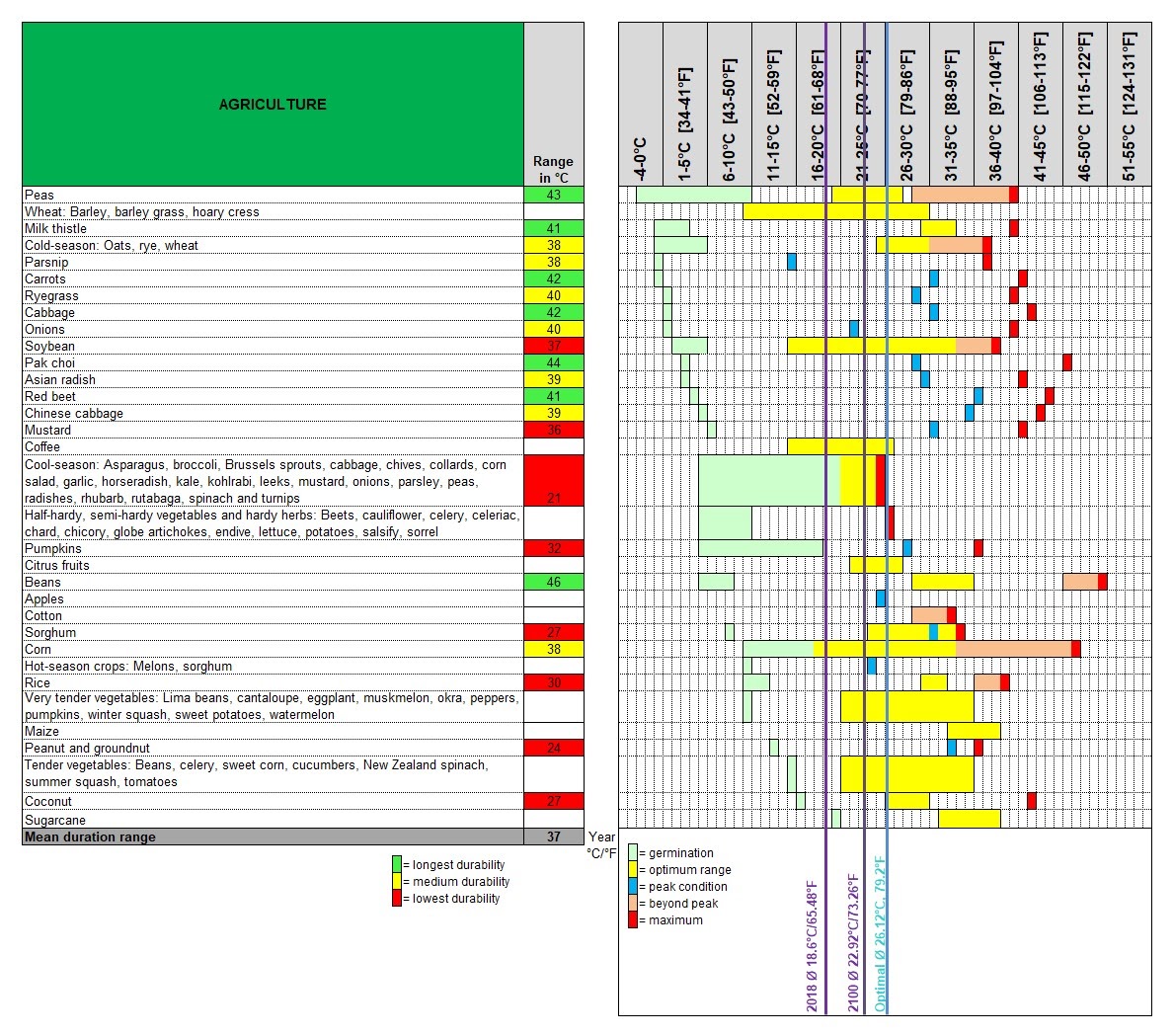

Cardinal temperature for agriculture production

Temperature range for agriculture production

Extinction-based market price predictions as deviations from normal price

Presentation at Harvard University

Harvard University, Mapping Climate Justice, Governance and Climate Justice, Book Launch Event, Julia M. Puaschunder, Palgrave Macmillan, 2020

Harvard University, Governance and Climate Justice Book Launch, Julia M. Puaschunder, Palgrave Macmillan, 2020

Funding Climate Justice:

Redistribution Taxation-Green Bonds Strategy

Today’s urgent global challenges in regards to climate change demand for fast action of the global community. Recent research has elucidated the economic impact of climate change on the world and found stark national differences in Gross Domestic Product (GDP) prospect under climate change around the world. Climate inequality arises within society, between nations as well as inbetween generations.

Source below: Puaschunder, J.M. (2022). Environmental Justice. Dissertation in the Interuniversity Consortium of New York.

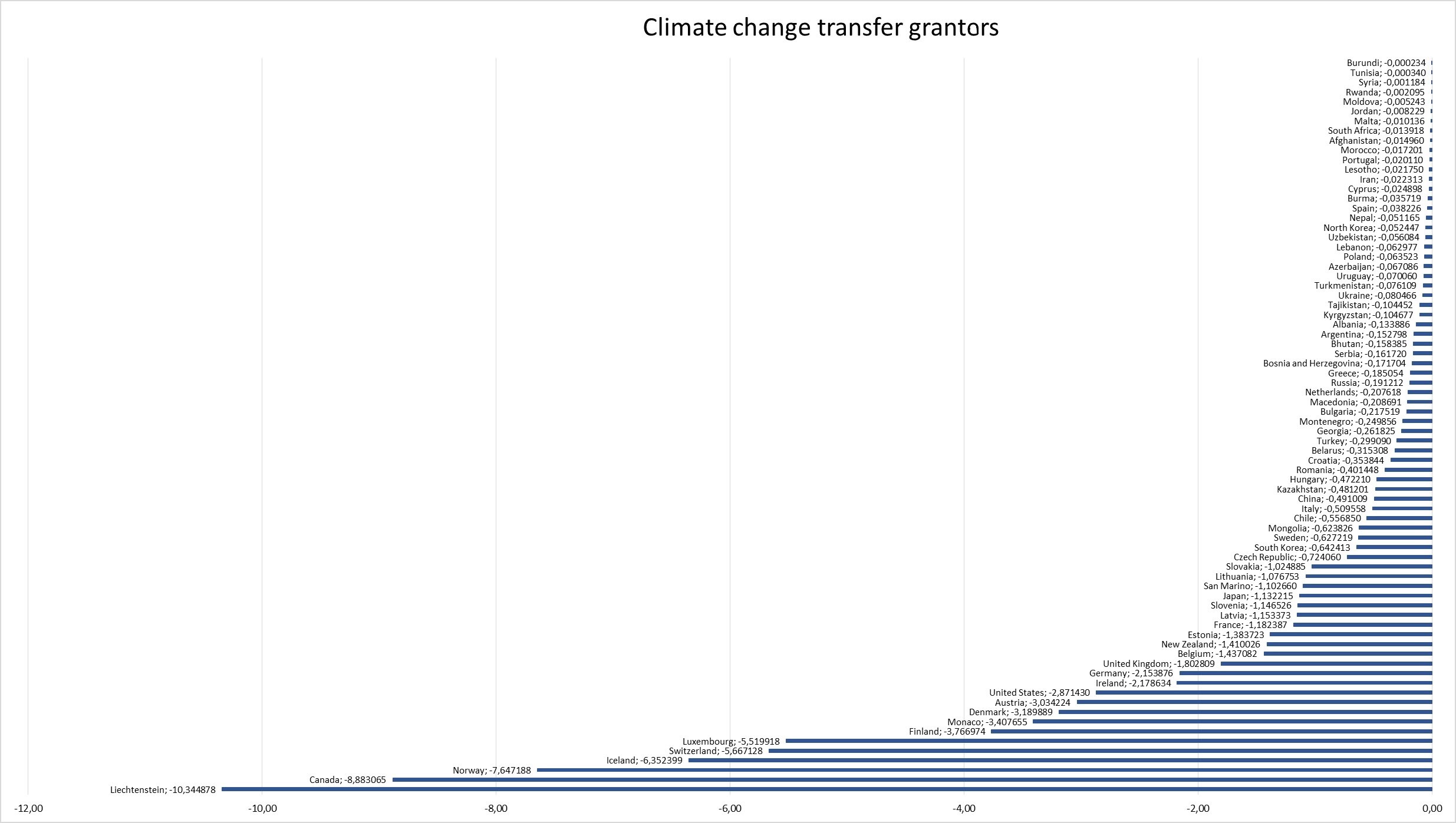

Climate inequalities are proposed to be alleviated by redistribution mechanisms enacted by a taxation-and-bonds strategy in a simple redistribution model and a sophisticated 9 index strong redistribution proposal.

A 9-index redistribution model for economic prospects under climate change is introduced in order to determine a fair share of relative expected short-term economic gains under global warming in order to offset for economic losses based on economic, ecologic, historic and political factors. The model determining redistribution patterns throughout the world is based on the geo-impact of climate change, the financial crisis resilience capabilities as well as the global connectivity and science diplomacy leadership of a country.

Empirically, nine indices provide a basis to determine which countries should be using a taxation strategy and what countries should be granted climate bonds premiums in order to enact a fair redistribution between countries. A country’s starting ground on the climate gains and losses spectrum, a country’s climate flexibility in terms of temperature zones and a country’s CO2 emissions contributions in production and consumption levels as well as a country’s CO2 emissions levels changes and the historically-grown bank lending rate as well as resilient finance strategies coupled with science diplomacy leadership and economic connectivity on the international level determine whether a country is on the taxation regime for funding mutual climate stabilization or whether a country will be on the receiving end of the climate bonds solution. The countries economically gaining from climate change and being climate flexible as well as countries with high CO2 emissions and not changing CO2 emissions levels as well as consuming goods and services from other countries but also having favorable bank lending rates and a history of resilience finance and crisis intervention expertise but also embodying science diplomacy and trade leadership advantages could be taxed to transfer funds via climate bonds for regions of the world that are losing from global warming and are not climate flexible as well as countries with low CO2 emissions and lowering CO2 emissions levels that are producing goods and services that are consumed in other parts of the world as well as having unfavorable bank lending rates and missing resilience finance expertise as historic science diplomacy and trade followers. The proposed taxation and bonds strategy could aid a broad-based and long-term market incentivization of a transition to a clean energy economy.

Source: Puaschunder, J.M. (forthcoming 2023). The Future of Resilient Finance: Finance Politics in the Age of Sustainable Development. New York: Palgrave Macmillan.

The following worldmaps color those countries in red that are advised to fund climate bonds with a taxation strategy. The greener the country is colored, the higher bond premiums are advised to be paid out in this country. Countries that range in the middle of the index are displayed in yellow in the display spectrum from countries ranked on taxation strategy in red to the highest bonds premium recipient country colored in green.

(1) Climate winners and losers CO2 emission Index: Climate justice between countries could be based on the idea that climate change winning countries that contribute to human-made global warming in CO2 emissions should pay for the establishment and maintenance of climate bonds via carbon taxation, while climate change losing territories with low CO2 emissions should be climate bond issuers with a higher interest rate premium.

(2) Climate winners and losers’ climate flexibility and CO2 emission Index: Climate change winning countries that feature relative climate flexibility in terms of temperature ranges on their territory and that contribute to human-made global warming in CO2 emissions should pay for the establishment and maintenance of climate bonds via carbon taxation; while climate change losing territories with low CO2 emissions and a narrow range of temperatures on their soil and thus low climate flexibility should be recipients of climate bonds with relative high interest rate premium and thus be relative beneficiaries in the common climate taxation-and-bonds transfer scheme.

(3) Climate winners and losers CO2 emission change Index: Climate justice over time could be fortified by climate change winning countries that contribute to human-made global warming in CO2 emissions and have a rising trend of CO2 emissions compared to other countries that should pay for the establishment and maintenance of climate bonds via carbon taxation; while climate change losing territories with low CO2 emissions that have declining CO2 emissions compared to other countries should be recipients of climate bonds with higher interest rates and thus be climate bond premium beneficiaries. This would create market incentives for countries to compete over CO2 emissions reductions and naturally lead towards a transition to renewable energy. As Puaschunder (2020b) found a correlation between being a climate change winner and CO2 emissions; the combination of having been a climate winner and having caused the climate problem is likely. This index could incentivize positive changes over time and is only one proposed index measure that may be combined or exchanged by any of the other proposed indices.

(4) Climate winners and losers CO2 emission Financial Crisis Intervention Index: Climate justice between countries could be based on the idea that climate change winning countries that contribute to human-made global warming in CO2 emissions and have a history of financial crisis interventions should pay for the establishment and maintenance of climate bonds via carbon taxation; while climate change losing territories with low CO2 emissions that also have no crisis intervention expertise should be climate bond recipient beneficiaries being granted a relatively higher bond interest rate premium funded by taxation of CO2 emitting industries in climate winning countries with well-established financial crisis intervention means.

(5) Climate winners and losers CO2 emission Resilience Finance Index: Climate justice between countries could be based on the idea that climate change winning countries that contribute to human-made global warming in CO2 emissions and have expertise in resilience finance strategies should pay for the establishment and maintenance of climate bonds via carbon taxation; while climate change losing territories with low CO2 emissions that lack resilience finance infrastructures should be climate bond recipient beneficiaries being granted a relatively higher bond interest rate premium funded by taxation of CO2 emitting industries in climate winning countries with well-established resilience finance means.

(6) Climate winners and losers CO2 emission bank lending rate Index: Climate justice between countries could be based on the idea that climate change winning countries that contribute to human-made global warming in CO2 emissions and have a low bank lending rate should pay for the establishment and maintenance of climate bonds via carbon taxation; while climate change losing territories with low CO2 emissions that also have a high bank lending rate should be climate bond recipient beneficiaries being granted a relatively higher bond interest rate premium funded by taxation of CO2 emitting industries in climate winning countries with low bank lending rates.

(7) Climate winners and losers consumption-based, trade-adjusted CO2 emission Index: Climate justice between countries could be based on the idea that climate change winning countries that contribute to human-made global warming in CO2 emissions due to goods and services consumption should pay for the establishment and maintenance of climate bonds via carbon taxation; while climate change losing territories with low CO2 emissions in goods and services consumption should be climate bond issuers with a higher interest rate premium.

(8) Science Diplomacy Climate Responsibility Index: The implementation of climate justice between countries could be based on the idea that climate change winning countries that contribute to human-made global warming in CO2 emissions due to goods and services consumption and have an established science diplomacy expertise with networks around the world should have a heightened responsibility to protect from climate change and pay for the establishment and lead in implementing the maintenance of climate bonds via carbon taxation; while climate change losing territories with low CO2 emissions goods and services consumption that are not so well versed in science diplomacy should follow the plan to accept climate bonds transfer payments with a higher interest rate premium.

(9) Global Connectivity Climate Responsibility Index: The implementation of climate justice between countries could be based on the idea that climate change winning countries that contribute to human-made global warming in CO2 emissions due to goods and services consumption and have an established global connectivity through trade, finance and human capital transfer with networks around the world should have a heightened responsibility to protect from climate change and pay for the establishment and lead in implementing the maintenance of climate bonds via carbon taxation; while climate change losing territories with low CO2 emissions goods and services consumption that are not so well versed in global networking should follow the plan to accept climate bonds transfer payments with a higher interest rate premium.

Coverage:

Berkeley Law School

Callaway Climate Insights

Duke University, Finance Regulation Blog, March 2, 2022

Duke University, Finance Regulation Blog, October 30, 2020

Environmental Sustainability, National Library of Medicine

MIT (Global Environmental Politics)

Nature, 2022

Nature, 2019

Latin American Post

Legal Theory Blog

Pension Policy International, August 20, 2017

Progress in Development Studies

Replication study (N>70,000) of Ethical Decision Making under Social Uncertainty

Science Alert

Sustainability at Harvard University

TaxProf Blog

The Intergenerational Foundation

United Nations Economic and Social Commission for Asia and the Pacific (UNESCAP)

University of Hawai’i, Manoa

United States National Academy of Sciences, Julia M. Puaschunder, Washington D.C.

~

United Nations New York, Julia M. Puaschunder

~

American Association for the Advancement of Science, Julia M. Puaschunder, Washington D.C.

~

United States National Academy of Sciences, Julia M. Puaschunder, Washington D.C.

~

Adam Smith School at University of Glasgow, Julia M. Puaschunder, Annual Conference of the Europeanists, Council for European Studies

Adam Smith Business School, University of Glasgow, Council for European Studies

~

Since 2018, Julia M. Puaschunder served as Chair General at over twenty International Research Association for Interdisciplinary Sciences (RAIS) Conferences on Social Sciences and Humanities hosted at Princeton University, Georgetown University, Johns Hopkins University and Washington DC.

Georgetown University, Research Association for Interdisciplinary Studies

~

Mapping Climate Justice, Julia M. Puaschunder, Buenos Aires, Argentina, South America

Buenos Aires, IAE Business School

~

Mapping Climate Justice, Resilience Finance watch, Julia M. Puaschunder, Puerto Rico

~

Spanish Royal Academy of Sciences, Julia M. Puaschunder

Royal Academy of Science of Spain

sponsored by Instituto de Ciencias Matemáticas and

Ministerio de Economía, Industria y Competitividad de España

~

George Washington University School of Business, Julia M. Puaschunder, Center for International Business Education and Research, Fellowship

‘Intergenerational Responsibility in the 21st Century’

Book release at George Washington University, Washington D.C.

~

Mapping Climate Justice, Visiting researcher Julia M. Puaschunder, first-ever hurrican in Europe watch

Iconic first-ever Mediterranean hurricane in the Aegean Sea watch at Acropolis, Greece, European Union

~

Arctic circle watch

Declining winter and melting glaciers watch, Iceland, between European and North American tectonic plates

~

Small Nation Island States

Climate extremes and hurricane resilience watch, Bahamas, Caribbean

~

Climate Change, Coasts, and Communities Symposium

Julia Puaschunder Panel Keynote Monmouth University

Monmouth University, New Jersey, USA

~

Hawaii

Seismic activity land creation watch, Hawai’i, USA

~

Spreading desert and drought observance

Cairo, Egypt, Africa

Jerusalem, Middle East

Desert & Singing Dunes watch, Death Valley, Nevada, United States of America

~

Rising sea level watch

San Servolo at Venice, Italy, European Union

Casablanca, Morocco, Africa

Budapest, Hungary, European Union

Saint Petersburg, Russian Federation

Santo Domingo, Dominican Republic

Florida, United States

Aruba, Caribbean

~

Mapping Climate Justice in India, University of Delhi, Faculty of Management Studies, 2019

~

Climate change world glacier observatory

Mauna Loa, Hawai’i, USA

~

Climate change glacier observation, Himalayan region, Kathmandu, Nepal

~

Circular economy witness, Havana, Cuba, Caribbean

~

Founder & Principal Investigator:

Julia M. Puaschunder

Columbia University

Graduate School of Arts and Sciences

Julia.Puaschunder@columbia.edu

https://blogs.cuit.columbia.edu/jmp2265/

New York, NY 10025, USA

https://portfolio.newschool.edu/juliapuaschunder/

https://portfolio.newschool.edu/puasj942

~

Cooperation partners:

Columbia University in the City of New York

Friends of the International Institute for Applied Systems Analysis (IIASA) (FoI)

George Washington University School of Business

CIBER – Center for International Business Education and Research

Harvard Law School Situationist Project on Law and Mind Sciences

International Institute for Applied Systems Analysis (IIASA)

Interuniversity Consortium of New School

Oikos International New York City Chapter

The New School Department of Economics

The Parsons School of Design

~

Advisory Board:

Oikos International New York City Chapter Board of Directors from 2016 to 2019

~

Financial and in-kind support of the Austrian Federal Ministry of Science, Research and Economy, Austrian Academy of Sciences, Bard Center for Environmental Policy, Elisabeth und Helmut Uhl Stiftung, Fritz Thyssen Foundation, George Washington University, Georgia State University Center for the Economic Analysis of Risk, HSBC Bank USA, Huebner Foundation for Insurance Education, ideas42, INSEAD Initiative for Learning Innovation and Teaching Excellence, International Association for Political Science Students, International Institute for Applied Systems Analysis, The New School for Social Research New York (Endowment Stipend, Fee Board Scholarship, President’s Scholarship), New School University Senate, Prize Fellowship of the Inter-University Consortium of New York, Science and Technology Global Consortium, University of Vienna, Vernon Art and Science, and the Vienna University of Economics and Business is gratefully acknowledged.

Output:

Work-in-progress

Books

Florea, N. & Puaschunder, J.M. (under review). The public’s environmental economics and policy making’s guide to climate change mitigation. University of Toronto Press.

Invited Section Editor: Encyclopedia of Contemporary Leadership and Change.

Puaschunder, J.M. (forthcoming 2023). The Future of Resilient Finance: Finance Politics in the Age of Sustainable Development. Palgrave Macmillan.

Puaschunder, J.M. (forthcoming 2023). Responsible Investment around the World: Finance after the Great COVID-19 Reset. Emerald.

Puaschunder, J.M. (Co-editor, forthcoming). Women in Climate 2021: Climate and Decision Making. Frontiers.

Publications:

Puaschunder, J.M. (2022). Environmental Justice. Dissertation in the Interuniversity Consortium of New York.

Puaschunder, J.M. (2022). Ethics of Inclusion: The Cases of Health, Economics, Education, Digitalization and the Environment in the post-COVID-19 Era. Bury St. Edmunds: Ethics International.

Puaschunder, J.M. (2020). Governance and Climate Justice: Global South and Developing Nations. New York, New York: Palgrave Macmillan. Cham, Switzerland: Springer Nature.

Puaschunder, J.M. (2019). Intergenerational Equity: Corporate and Financial Leadership. Cheltenham, UK & Northampton, MA: Edward Elgar.

Puaschunder, J.M. (2019). (Ed.), Intergenerational Governance and Leadership in the Corporate World. Hershey, Pennsylvania: IGI.

Puaschunder, J.M. (2019). Corporate and Financial Intergenerational Leadership. Lady Stephenson, Newcastle upon Tyne, UK: Cambridge Scholars Publishing.

Puaschunder, J.M. (2018). Corporate Social Responsibility and Opportunities for Sustainable Financial Success. Hershey, Pennsylvania: IGI.

Puaschunder, J.M. (2017). Global Responsible Intergenerational Leadership: A Conceptual Framework and Implementation Guidance for Intergenerational Fairness. Wilmington, US: Vernon Press.

Puaschunder, J.M. (2017). (Ed.), Intergenerational Responsibility in the 21st Century. Wilmington, US: Vernon Press.

Puaschunder, J.M. (2010). On Corporate and Financial Social Responsibility. Vienna, Austria: University of Vienna.

Articles

Work-in-progress

Puaschunder, J.M. & Schwarz, G. (under review). The future is now: How joint decision-making curbs hyperbolic discounting but blurs social responsibility in the intergenerational equity public policy domain.

Puaschunder, J.M. (forthcoming). Funding Climate Justice: Green Bonds and Diversified Interest Rates. In: S. Boubaker & L.T. Han, Handbook of Environmental and Green Finance: Towards a Sustainable Future, World Scientific.

Puaschunder, J.M. (forthcoming). Educating the Sustainability Leaders of the Future. In W. Leal, Educating the Sustainability Leaders of the Future, Springer Nature.

Puaschunder, J.M. (forthcoming). The future of resilient finance: The relation of cryptocurrencies and sustainability ethics. In W. Leal, Climate Change Policies: Science and Technology in Support of Policy-Making in Climate Change Mitigation and Adaptation, Springer Nature.

Puaschunder, J.M. (forthcoming). Gender inequality in the global warming era: The disparate impact of climate change on female. In: Dipanwita Pal (Ed.), Gendering the Environment: A Critical Study of the Ecofeminist Orientations of the Women Writers. Cambridge, UK: Cambridge Scholars.

Puaschunder, J.M. (forthcoming). Climate Justice Leadership. In: Rajendra Baikady, S.M. Sajid, Varoshini Nadesan, Jaroslaw Przeperski, M. Rezaul Islam, Jianguo Gao (Eds.), The Palgrave Handbook of Global Social Change. Cham: Palgrave.

Published articles

Puaschunder, J.M. (2022). Science Diplomacy Index: Leadership and Responsibility to Act on Climate Change. Scientia Moralitas: International Journal of Multidisciplinary Research, 7, 2, 11-30.

Puaschunder, J.M. (2019). An inquiry into the nature and causes of Climate Wealth of Nations: What temperature finance gravitates towards? Sketching a climate-finance nexus and outlook on climate change-induced finance prospects. Archives of Business Research, 7, 3, 183-217.

Puaschunder, J.M. (2018). Intergenerational leadership: An extension of contemporary corporate social responsibility models. Corporate Governance & Organizational Behavior Review, 2, 1, 7-17.

Puaschunder, J.M. (2018). The history of ethical, environmental, social and governance-oriented investments as a key to sustainable prosperity in the finance world. Public Integrity, 1, 1-21.

Puaschunder, J.M. (2017). Mapping climate justice: Visualizing the burden of climate stabilization. Public Seminar, New York: The New School.

Puaschunder, J.M. (2017). Financing Climate Justice through Climate Change Bonds. Oxford Journal of Finance and Risk Perspectives, 6, 3, 1-10.

Puaschunder, J.M. (2017). Mapping climate justice in the 21st century. Agriculture Research and Technology, 10, 5, 1-3.

Puaschunder, J.M. (2017). Mapping climate in the 21st century. Development, 60, 10, 1057, 1-6.

Puaschunder, J.M. (2017). Ethical, environmental, social and governance-oriented investments. Archives of Business Research, 5, 8, 151-159.

Puaschunder, J.M. (2017). Krisenrobuste Alternativen [Crisis-robust financial market alternatives]. Global Investor, 3, 5, 69.

Puaschunder, J.M. (2017). We – today’s and tomorrow’s – people of the United World: Rethinking capitalism for intergenerational justice in the fin-de-millénaire. Corporate Governance and Sustainability Review, 1, 2, 30-35.

Puaschunder, J.M. (2017). The climatorial imperative. Agriculture Research and Technology, 7, 4, 1-2.

Puaschunder, J.M. (2017). Ethical decision making under social uncertainty: An introduction to Überethicality. Sustainable Production and Consumption, 12, 78-89.

Puaschunder, J.M. (2017). Socio-psychological motives of socially responsible investors. Global Corporate Governance: Advances in Financial Economics, 19, 209-247.

Puaschunder, J.M. (2017). Intergenerational leadership: Coordinating common goods and economic stability. Journal of Applied Business and Economics, 19, 11/12, 65-78.

Puaschunder, J.M. (2016). On the emergence, current state and future perspectives of Socially Responsible Investment (SRI). Consilience: The Columbia University Journal of Sustainable Development, 16, 1, 38-63.

Puaschunder, J.M. (2016). Intergenerational climate change burden sharing: An economics of climate stability research agenda proposal. Global Journal of Management and Business Research:Economics and Commerce, 16, 3, 31-38.

Puaschunder, J.M. (2016). The role of political divestiture for sustainable development. Journal of Management and Sustainability, 6, 1, 76-91.

Puaschunder, J.M. (2016). Intergenerational equity in the eye of overindebtedness. Canon: An Interdisciplinary Journal of The New School for Social Research, Fall 2016, 2-5.

Puaschunder, J.M. (2016). On eternal equity in the fin-de-millénaire: Rethinking capitalism for intergenerational justice. Journal of Leadership, Accountability and Ethics, 13, 2, 11-24.

Puaschunder, J.M. (2015). When investors care about politics: A meta-synthesis of political divestiture studies on the capital flight from South Africa during Apartheid. Business, Peace and Sustainable Development, 5, 24, 29-52.

Puaschunder, J.M. (2016). Global responsible intergenerational leadership: The quest of an integration of intergenerational equity in Corporate Social Responsibility (CSR) models. Annals in Social Responsibility, 2, 1, 1-12.

Puaschunder, J.M. (2015). On the social representations of intergenerational equity. Oxford Journal on Finance and Risk Perspectives, 4, 4, 78-99.

Chapters

Puaschunder, J.M. (2022). Governance of Climate Justice: Taxation Transfers and Green Bonds. In: Leal Filho, W., Aguilar-Rivera, N., Borsari, B., R.B. de Brito, P., Andrade Guerra, B. (Eds.) SDGs in the Americas and Caribbean Region. Implementing the UN Sustainable Development Goals – Regional Perspectives. Springer, Cham.

Puaschunder, J.M. (2022). Global Leadership and Followership on Climate Justice. In: Satinder Dhiman, Joan Marques, June Schmieder-Ramirez & Petros G. Malakyan (2021). Handbook of Global Leadership and Followership: Integrating the Best Leadership Theory and Practice, Cham: Springer Nature.

Puaschunder, J.M. (2022). Corporate and Financial Social Leadership in emerging markets and the developing world. In: Research Anthology on Developing Socially Responsible Businesses, pp. 1265-1287. Hershey, PA: Information Management Resources Association.

Puaschunder, J.M. (2022). Climate action: Top-down climate control. In: Encyclopedia of the UN Sustainable Development Goals. Cham: Springer Nature.

Puaschunder, J.M. (2022). Governance and climate justice. In: Encyclopedia of the UN Sustainable Development Goals. Cham: Springer Nature.

Puaschunder, J.M. (2021). Towards Global Environmental Governance. In: Francisco. Carrillo & Günter Koch, Knowledge for the Anthropocene: A Multidisciplinary Approach, pp. 194-203, Edward Elgar.

Puaschunder, J.M. (2021). Financial sustainability conscientiousness. In: Othmar Lehner (Ed.), A Research Agenda for Social Finance, pp. 199-223, Edgar Elgar EE Research Agenda book series.

Puaschunder, J.M. (2020). Corporate and Financial Social Leadership in emerging markets and the developing world. In: Anetta Kuna-Marszałek & Agnieszka Klysik-Uryszek (2020), CSR and Socially Responsible Investing Strategies in Transitioning and Emerging Economies, pp. 23-45, United States: IGI Publishing.

Puaschunder, J.M. (2020). Life on land: Bottom-up sustainability conscientiousness. In Walter Leal Filho, A.M. Azul, L. Brandli, A.L. Salvia & T. Wall (Ed.), Encyclopedia of the UN Sustainable Development Goals, pp. 108-118. Cham: Springer Nature.

Puaschunder, J.M. (2019). Long-term investments. In Walter Leal Filho et al. (Ed.), Partnerships for the Goals: Encyclopedia of the UN Sustainable Development Goals. Cham: Springer Nature.

Puaschunder, J.M. (2019). When investors care about causes: Learning from political divestiture during Apartheid and the Sudan crisis for the transition to renewable energy via green bonds. In F. Lukhele (Ed), Apartheid in South Africa: Reflections and Lessons, pp. 1-28. Hauppauge, NY: Nova.

Puaschunder, J.M. (2019). Mapping climate justice: Future climate wealth of nations. In Julia Margarete Puaschunder (Ed.), Intergenerational Governance and Leadership in the Corporate World, pp. 178-190, Hershey, PA: Idea Group.

Puaschunder, J.M. (2019). Intergenerational governance and leadership around the world. In Julia Margarete Puaschunder (Ed.), Intergenerational Governance and Leadership in the Corporate World, pp. 153-177, Hershey, PA: Idea Group.

Puaschunder, J.M. (2019). Lessons from divesting South Africa during Apartheid for a green economy. In Albert Tavidze (Ed.), Progress in Economics Research, pp. 119-147. Hauppauge, NY: Nova.

Puaschunder, J.M. (2018). Climate policies with burden-sharing: The economies of climate financing. In: John Kose, Anil Makhija & Stephen P. Ferris (2018). International Corporate Governance and Regulation: Advances in Financial Economics, 19, pp. 1-13, Bingley: Emerald.

Puaschunder, J.M. (2018). The history of ethical, environmental, social and governance-oriented investments as a key to sustainable prosperity in the finance world. In: Sabri Boubaker, S. & Duc K. Nguyen (Eds.), Corporate Social Responsibility, Ethics and Sustainable Prosperity, pp. 359-388, Hershey: IGI.

Puaschunder, J.M. (2018). Socially responsible investment. In Ali Farazmand (Ed.), Global Encyclopedia of Public Administration, Public Policy, and Governance. Cham, Switzerland: Springer Nature: Springer International Publishing.

Puaschunder, J.M. (2018). Socio-psychological motives of Socially Responsible Investments (SRI). In Sabri Boubaker, Douglas Cumming & Duc K. Nguyen (Eds.), pp. 447-472, Research Handbook of Investing in the Triple Bottom Line: Finance, Society and the Environment. London: Edward Elgar

Puaschunder, J.M. (2018). Nachhaltigkeit und Investment: Psychologische Aspekte von nachhaltigkeitsorientiertem Investitionsverhalten. [Sustainability and Investment: Psychological aspects of sustainable finance] In: Claudia Schmitt & Eva Bamberg (Eds.), Psychologie und Nachhaltigkeit: Konzeptionelle Grundlagen, Anwendungsbeispiele und Zukunftsperspektiven, pp. 127-134, Springer.

Puaschunder, J.M. (2018). The history of ethical, environmental, social and governance-oriented investments as a key to sustainable prosperity in the finance world. Public Integrity, 1, 1-21.

Puaschunder, J.M. (2018). Global responsible intergenerational leadership: Coordinating common goods and economic stability. In Julia M. Puaschunder (Ed.), Intergenerational Responsibility in the 21st Century, pp. 289-312, Wilmington, DE: Vernon Press.

Puaschunder, J.M. (2017). Cross-sectoral solution-finding and policy dialogue on Information and Communication Technologies for sustainable development. In Milenko Gudic, Tay K. Tan and Patricia M. Flynn, Beyond the Bottom Line: Integrating the UN Global Compact into Management Practices, pp. 32-46. New York, NY: Greenleaf Publishing.

Puaschunder, J.M. (2016). Socially responsible investment as emergent risk prevention and means to imbue trust in the post-2008/2009 world financial crisis economy. In: Othmar Lehner (Ed.), Routledge Handbook of Social and Sustainable Finance, pp. 222-238, London: Taylor & Francis.

Puaschunder, J.M. (2016). The call for global responsible inter-generational leadership: The quest of an integration of inter-generational equity in Corporate Social Responsibility (CSR) models. In: Dima Jamali (Ed.), Comparative Perspectives on Global Corporate Social Responsibility, pp. 276-289. Hershey: IGI Global Advances in Business Strategy and Competitive Advantage Book Series.

Puaschunder, J.M. (2016). The call for global responsible inter-generational leadership: The quest of an integration of inter-generational equity in Corporate Social Responsibility (CSR) models. In: Natural Resources Management: Concepts, Methodologies, Tools, and Applications. Information Resource Management Association, Hershey: IGI Publishing.

Puaschunder, J.M. (2013). Ethical investing and socially responsible investing. In Kent H. Baker & Victor Ricciardi (Eds.), Investor Behavior: The Psychology of Financial Planning and Behavior, pp. 515-532, New York: John Wiley & Sons Finance Series.

Proceedings:

Work-in-progress

Puaschunder, J.M. (forthcoming). Resilience leadership. Proceedings of the Scientia Moralitas conference. February 19, 2023.

Published

Puaschunder, J.M. (2022). Finance after the Great Reset: Resilience Finance, Responsible Investment and Finance Politics. Proceedings of the 29th International RAIS Conference on Social Sciences and Humanities organized by Research Association for Interdisciplinary Studies (RAIS), pp. 77-86, August 14, 2022.

Puaschunder, J.M. (2022). Science Diplomacy. Proceedings of the 29th International RAIS Conference on Social Sciences and Humanities organized by Research Association for Interdisciplinary Studies (RAIS), pp. 40-48, August 14, 2022.

Puaschunder, J.M. (2022). Intergenerational justice and democracy. Proceedings of the 28th Research Association for Interdisciplinary Studies (RAIS) conference, pp. 48-55, June 2022.

Puaschunder, J.M. (2022). Advances in Socially Responsible Investment in Resilience Finance. Proceedings of the 26th Research Association for Interdisciplinary Studies (RAIS) conference, pp. 79-85, February 2022.

Puaschunder, J.M. (2022). Defashionization for sustainability: From conspicuous to conscientious consumption: Breaking business cycles for environmentalism. Proceedings of the 26th Research Association for Interdisciplinary Studies (RAIS) conference, pp. 146-155, February 2022.

Puaschunder, J.M. (2021). Sustainable lifestyle revolution: Agrohoods, Ecowellness and Biophilia trends. Proceedings of the 25th Research Association for Interdisciplinary Studies (RAIS) conference, pp. 82-88, December 5, 2021.

Puaschunder, J.M. (2021). Climate stabilization Taxation-and-Bonds strategy adjusted for consumption. Proceedings of the 25th Research Association for Interdisciplinary Studies (RAIS) conference, pp. 44-50, December 5, 2021.

Tomek, R.S., Richter, R., Michalsen, A., Puaschunder, J.M., Quarch, Ch., Rohrbach, W., Vormann, J., Rehak, W. & Grimm, J. (2021). System change transformation of healthcare. Proceedings of the 3rd Unequal World Conference of the United Nations, United Nations New York, New York, United States.

Puaschunder, J.M. (2021). Climate Growth Theory. Proceedings of the 23rd Research Association for Interdisciplinary Studies (RAIS) conference, pp. 13-25, August 15, 2021.

Puaschunder, J.M. (2021). Environmental, Social and Corporate Governance (ESG) Diplomacy: The time has come for a Corporate and Financial Social Justice Great Reset. Proceedings of the 23rd Research Association for Interdisciplinary Studies (RAIS) conference, 119-124, August 15, 2021.

Puaschunder, J.M. (2021). Green Bonds and diversified interest rates. Proceedings of the 22nd Research Association for Interdisciplinary Studies (RAIS) conference, pp. 150-156, June 21, 2021.

Puaschunder, J.M. (2021). Equitable Green New Deal (GND). Proceedings of the 22nd Research Association for Interdisciplinary Studies (RAIS) conference, pp. 27-32, June 21, 2021.

Puaschunder, J.M. (2021). Environmental Justice. Proceedings of the Scientia Moralitas Conference, April 19, pp. 20-26.

Puaschunder, J.M. (2021). Ethics of the environment. Proceedings of the 21st Research Association for Interdisciplinary Studies (RAIS) conference, pp. 189-195, March 1, 2021.

Puaschunder, J.M. (2021). Monitoring and Evaluation (M&E) of the Green New Deal (GND) and European Green Deal (EGD). Proceedings of the 21st Research Association for Interdisciplinary Studies (RAIS) conference, pp. 202-206, March 1, 2021.

Puaschunder, J.M. (2021). Green New Deal leadership determinants of the 21st century: Teaching economics of the environment. Proceedings of the 21st Research Association for Interdisciplinary Studies (RAIS) conference, pp. 213-223, March 1, 2021.

Puaschunder, J.M. (2020). The future of the city after COVID-19: Digitionalization, Preventism and Environmentalism. Proceedings of the ConScienS online Conference on Science & Society: Pandemics and their Impact on Society, pp. 125-129, September 28-29, 2020.

Puaschunder, J.M. (2020). The Green New Deal: Economic fundamentals and implementation strategies. Proceedings of the 18th Research Association for Interdisciplinary Studies Conference at Princeton University, Princeton, New Jersey, United States, pp. 41-52, August 17-18.

Puaschunder, J.M. (2020). Environmental justice. Proceedings of the 16th Research Association for Interdisciplinary Studies Conference at Princeton University, Princeton, New Jersey, United States, pp. 160-165, March 30-31.

Puaschunder, J.M. (2019). Future climate wealth of nations’ winners and losers, Proceedings of the Sixth Annual International Conference on Sustainable Development (ICSD), Alfred Lerner Hall, Columbia University, New York, USA, September 24-25.

Puaschunder, J.M. (2019). Time ≠ time ≠ time: Mental temporal accounting. Proceedings of the International RAIS Conference on Social Sciences and Humanities organized by Research Association for Interdisciplinary Studies (RAIS) at Johns Hopkins University, Montgomery County Campus, Rockville, MD, United States, June 10-11.

Puaschunder, J.M. (2018). Climate wealth of nations. Proceedings of the 11th International Research Association for Interdisciplinary Studies (RAIS) Conference on Social Sciences, Johns Hopkins University, Montgomery County Campus, Rockville, MD, November 19.

Puaschunder, J.M. (2018). Financing climate justice through climate change bonds. Proceedings of the 16th Finance, Risk and Accountability Perspectives Conference: Sustainability and Risk: Environmental, Social and Governance Perspectives, University of Cambridge, Cambridge UK, Great Britain, September 25-27, 2017.

Puaschunder, J.M. (2018). Climate in the 21st century. Proceedings of the 8th International RAIS Conference on Social Sciences and Humanities organized by Research Association for Interdisciplinary Studies (RAIS) at Georgetown University, Washington, D.C., United States, pp. 205-243.

Puaschunder, J.M. (2017). Mapping climate justice. Proceedings of the Administrative Sciences Association of Canada (ASAC), HEC Montreal, Quebec, Canada, May 31.

Proceedings of the 2017 Research in Management Learning and Education Unconference at The New School New York, 18, December 1.

Puaschunder, J.M. (2017). Sunny side up! From climate change burden sharing to fair global warming benefits distribution: Groundwork on the metaphysics of the gains of global warming and the climatorial imperative. Proceedings of ST Global Consortium Annual Science and Technology Studies & Science and Technology Policy Conference of the United States National Academy of Science, Washington DC, USA, March 25, 2017.

Puaschunder, J.M. (2017). Ethical decision making under social uncertainty: An introduction to Überethicality. Sustainable Production and Consumption, 12, 78-89. Authorized reprint: Proceedings of the 2015 6th International Conference of the Association of Global Management Studies at Alfred Lerner Hall of Columbia University, New York: The Association of Global Management Studies.

Puaschunder, J.M. (2017). Socio-psychological motives of socially responsible investors. Global Corporate Governance: Advances in Financial Economics, 19, 209-247. Authorized reprint: Socio-psychological motives of socially responsible investors. Harvard University Weatherhead Center for International Affairs Paper, Harvard University. Featured by The Intergenerational Foundation

Puaschunder, J.M. (2017). Intergenerational leadership: Coordinating common goods and economic stability. Proceedings of the 2017 Industry Studies Association Conference, Washington DC, USA.

Puaschunder, J.M. (2016). Intergenerational leadership: Coordinating common goods and economic stability. Proceedings of the 2016 Research in Management Learning and Education Unconference at INSEAD, Fontainebleau, December 19, 2016.

Puaschunder, J.M. (2016). Mapping climate justice. IIASA 2016 Young Summer Scientists Program Proceedings, International Institute for Applied Systems Analysis (IIASA), Laxenburg, Austria, EU.

Puaschunder, J.M. (2016). Intergenerational climate change burden sharing: An economics of climate stability research agenda proposal. Global Journal of Management and Business Research:Economics and Commerce, 16, 3, 31-38. Authorized reprint: Proceedings of the Science and Technology Global Consortium 16th Annual Conference in Washington D.C., April 9, Washington D.C., The National Academies of Sciences.

Puaschunder, J.M. (2016). Socially responsible investment as emergent risk prevention and means to imbue trust in the post-2008/2009 world financial crisis economy. In O. Lehner (Ed.), Routledge Handbook of Social and Sustainable Finance, pp. 222-238, London: Taylor & Francis. Authorized reprint: Proceedings of the 2015 6th International Conference of the Association of Global Management Studies at Alfred Lerner Hall of Columbia University, New York: The Association of Global Management Studies.

Puaschunder, J.M. (2015). The call for global responsible intergenerational leadership in the corporate world: The quest of an integration of intergenerational equity in contemporary Corporate Social Responsibility (CSR) models. Proceedings of the 2015 6th International Conference of the Association of Global Management Studies at Alfred Lerner Hall of Columbia University, New York: The Association of Global Management Studies.

Puaschunder, J.M. (2015). Trust and reciprocity drive common goods allocation norms.

Proceedings of the Cambridge Business & Economics Conference, UK: Cambridge University.

Proceedings of the 2015 6th International Conference of the Association of Global Management Studies at Alfred Lerner Hall of Columbia University, New York: The Association of Global Management Studies.

Proceedings of the Academy of Management.

Nominated ‘Best Paper Award’ by the International Corporate Governance Society.

Puaschunder, J.M. (2015). On eternal equity in the fin-de-millénaire. Proceedings of the 22nd Annual International Vincentian Business Ethics Conference (IVBEC), 242-264.

Proceedings editor:

EcoWellness Group (2021). Salzburg European Declaration of the Conference “System Change 3 ?! – Die Transformation des Gesundheitswesens” [System Change 3 ?! – The Transformation of Healthcare], Bad Gastein, Austria, Europe, June 14-15, 2021.

Tomek, R.St., Richter, R., Lakonig, St., Bonelli, R.M., Hosang, M., Michalsen, A., Probst, T., Puaschunder, J.M., Rohrbach, W., Schuchardt, E., Vormann, J., Stordalen, G., Lehrach, H., Piketty, Th., Heinrichs, J. (2020). Salzburg Declaration. Press Release of the Conference Proceedings on ‘System Change?! Die Chance der Transformation des Gesundheitswesens: Analyse und Chancen des Gesundheitswesens,’ July 14-15.

Copyrights:

Puaschunder, J.M. (2016). Intergenerational climate change burden sharing: An economics of climate stability research agenda proposal. Copyright Office of the United States Congress. TXu001995185 / 2016-03-01.

Puaschunder, J.M. (2012). On the social representations of intergenerational equity. Copyright Office of the United States Congress. TXu001798159 / 2012-02-26.

Puaschunder, J.M. (2011). Intergenerational equity as a natural behavioral law. Copyright Office of the United States Congress. TXu 1-743-422 / 2011-03-08.

Puaschunder, J.M. (2011). Ethical decision making under social uncertainty: An introduction of Überethicality. Copyright Office of the United States Congress. TXu001782130 / 2011-11-04.

Working paper:

Orlov, S., Rovenskaya, E., Puaschunder, J.M. & Semmler, W. (2018). Green bonds, transition to a low-carbon economy, and intergenerational fairness: Evidence from an extended DICE model. International Institute for Applied Systems Analysis Working Paper WP-18-001. IIASA, Laxenburg, Austria, European Union.

Puaschunder, J.M. (2012). Socio-psychological motives of socially responsible investors. Harvard University Weatherhead Center for International Affairs Paper, Harvard University. Featured by The Intergenerational Foundation

Puaschunder, J.M. (2011). On the emergence, current state and future perspectives of Socially Responsible Investments. The Weatherhead Center for International Affairs Paper, Harvard University.

Report:

‘Klimawandel’ (2015-19). Fritz Thyssen Stiftung Report. Cologne, Germany, European Union.

Blog contributions:

Puaschunder, J.M. (2022). Intergenerational equity and the U.S. Judiciary. Intergenerational Foundation Blog, July 20th, 2022, https://www.if.org.uk/2022/07/20/intergenerational-equity-and-the-us-judiciary/

Puaschunder, J.M. (2022). Financing Climate Justice: Taxation-and-bonds strategy. The FinReg Blog, Global Financial Markets Center, Duke University School of Law, March 2, 2022.

Puaschunder, J.M. (2020). The Green New Deal: Historical foundations, economic fundamentals and implementation strategies. The FinReg Blog, Global Financial Markets Center, Duke University School of Law, October 30, 2020.

Puaschunder, J.M. (2017). Mapping climate justice: Visualizing the burden of climate stabilization. Public Seminar, New York: The New School.

Invited guest lectures & presentations:

Puaschunder, J.M. (2023). Resilience leadership. Scientia Moralitas conference. February 19, 2023.

Puaschunder, J.M. (2023). Prospect theory incentives in ‘pay for sustainability’ remuneration schemes. Scientia Moralitas conference. February 19, 2023.

Puaschunder, J.M. (2023). Funding Climate Justice: Taxation Transfers and Green Bonds. Society of Government Economists virtual seminar ‘The Use of Data Analytics and Data Science in Policy Analysis,’ February 10, 2023.

Puaschunder, J.M. (2023). The Future of Resilience Finance. Special Keynote Address for the Indian Institute of Finance, International Research Conference & Award Summit,Delhi, India, Asia, January 6, 2023.

Puaschunder, J.M. (2022). Die neuen Definitionen von Gesunde Firma, Gesunde Wirtschaft, Gesundheits-Region. Ecowellness Board Meeting, Berlin, Germany, European Union, December 19, 2022.

Puaschunder, J.M. (2022). Die neuen Definitionen von Gesunde Firma, Gesunde Wirtschaft, Gesundheits-Region. Ecowellness Board Meeting, Berlin, Germany, European Union, December 17, 2022.

Puaschunder, J.M. (2022). Die neuen Definitionen von Gesunde Firma, Gesunde Wirtschaft, Gesundheits-Region. Ecowellness Board Meeting, Kassel, Germany, European Union, December 13, 2022.

Puaschunder, J.M. (2022). Resilience Finance: The role of diversity, hope, and science diplomacy. The New School for Social Research (NSSR) Economics Research Workshop: Climate Change and Dynamic Macroeconomics: New Perspectives on Climate Economics, October 25, 2022.

Puaschunder, J.M. (2022). Financing Climate Justice: Taxation transfers and green bonds for environmental inclusion. Workshop on Carbon Finance, FernUni Hagen, Germany, European Union, March 9, 2022.

Puaschunder, J.M. (2021). Environmental economics from a Behavioral Insights view. Invited guest lecture Bias Bocconi Behavioral Insights Association of Students at Bocconi University, Milan, Italy, European Union, December 2.

Puaschunder, J.M. (2021). Invited Panel appearance on Climate Justice Knowledge Systems. Emerging Knowledge Systems Panel at the Knowledge Cities World Summit 2021, City Living Lab, Caxias do Sul, Brazil, South America, November 16, 2021.

Puaschunder, J.M. (2021). The multiple dimensions of Climate Justice: With a focus on climate justice across countries. Online Workshop: Climate Change and Macroeconomics: New Perspectives on Climate Economics, The New School Department of Economics, The New School, New York, New York, USA, November 13, 2021.

Puaschunder, J.M. (2021). Invited Panel appearance at the Environmental Impact Finance and Accounting for Sustainability (EIFAS) 2021 Symposium. Oxford – London – Helsinki. Research Symposium on Environmental Impact Finance and Accounting for Sustainability, November 11, 2021.

Puaschunder, J.M. (2021). Invited lecture on economic, psychological and political developments in the U.S. and Europe on System Change. Followed by moderating a Panel on the Salzburg European Declaration from the Gasteinertal, Ecowellness Group Annual Meeting, Grand Hotel de l’Europe, Bad Gastein, Austria, European Union, July 15, 2021.

Puaschunder, J.M. (2021). Monitoring and Evaluation (M&E) Collaborative Association (MECA) Annual Conference, a panel on Monitoring and Evaluation in Environmental Economics, April 16, The New School.

Puaschunder, J.M. (2021). Scientific Conference Board and Special Issue Scientific Committee member, Finance, Risk and Accounting Perspectives (FRAP) Conference on‘Sustainability Accounting and Finance meets AI and Big Data’ of the Oxford Academic Research Network (ACRN

Puaschunder, J.M. (2021). Ethical Dilemmas Carthage Symposium, Carthage College, Kenosha, Wisconsin, Madison, United States, invited guest lecture, February 23.

Puaschunder, J.M. (2019). Environmental justice. Natasha Chichilnisky-Heal Environmental Justice Fund Inauguration Conference, Yale University, New Haven, United States, November 15.

Puaschunder, J.M. (2019). Future climate wealth of nations. Invited talk The New School, Global, Urban, and Environmental Studies, School of Public Engagement, New York, New York, October 23.

Puaschunder, J.M. (2019). Climate wealth of nations. Guest lecture in Practice Capstone Project: Model G-20. The New School, New York, New York, United States, September 11.

Puaschunder, J.M. (2019). Climate Change, Coasts, and Communities Symposium Panelist, Monmouth University, New Jersey, United States, April 17-18.

Puaschunder, J.M. (2019). Intergenerational equity. Generation Citizen Guest Speaker, Frank Sinatra School of the Arts High School, Astoria, Queens, New York, April 9.

Puaschunder, J.M. (2019). Future climate wealth of nations. Columbia University, Department of Economics, International Affairs Building, New York, New York, USA, February 20.

Puaschunder, J.M. (2019). Future climate wealth of nations. Harvard University, Department of Chemistry, 12 Oxford Street, Cabot Division Room, Cambridge, MA, USA, February 11.

Invited participant, Workshop on ‘Science, Technology and Economic Policy,’ National Academy of Sciences, Engineering, Medicine, invited by the Harvard Laboratory for Innovation Sciences at The Keck Center for the National Academies, Washington DC, USA, May 29, 2019.

Puaschunder, J.M. (2018). Model G20 on climate change. Preparation course for Model G20 competition. The New School International Affairs Program. New York, New York, USA, September 13.

Puaschunder, J. M. (2018). Research for a Sustainable Future. Invited Keynote Address, Fourth American Academic Research Conference on Global Business, Economics, Finance and Social Sciences, Wagner College, New York, New York, United States, April 13.

Puaschunder, J.M. (2018). Climate change and intergenerational equity panel. Equity for Children. The New School, New York, March 29.

Puaschunder, J.M. (2017). Mapping climate justice: Sunny side up! From climate change burden sharing to fair global warming benefits Distribution: Groundwork on the metaphysics of the gains of a warming earth and the climatorial imperative, 17th Annual Science and Technology Studies & Science and Technology Policy Conference of the American Association for the Advancement of Science, American Association for the Advancement of Science & National Academy of Sciences, Washington DC, USA, March 25.

Puaschunder, J.M. (2017). Sunny side up! From climate change burden sharing to fair global warming benefits distribution: Groundwork on the metaphysics of the gains of a warming earth and the climatorial imperative, Economics of Climate Change Laboratory, The New School, Department of Economics, New York, New York, USA, March 17.

Puaschunder, J.M. (2017). How to use carbon tax revenues, guest presentation, Economics of Climate Change, The New School, Department of Economics, New York, New York, USA, March 3.

Puaschunder, J.M. (2016). Mapping Climate Justice. Cambridge University Apotheosis Society Retreat, Würzburg, Germany, European Union, December 9-11.

Puaschunder, J.M. (2016). Mapping climate justice, Oikos International New York City Chapter Guest Lecture, The New School, New York, New York, USA, November 3.

Puaschunder, J.M. (2016). Globalization and geopolitics: The new economy is flat! Strategic Design and Management in New Economies, Guest Lecture, Parsons School of Design, The New School, New York, NY, USA, September 27.

Puaschunder, J.M. (2016). Mapping Climate Justice, Strategic Design and Management in New Economies, Guest Lecture, Parsons School of Design, The New School, New York, NY, USA, September 13.

Puaschunder, J.M. (2016). IntergenerationaI ideals for our time. Ideals for out Time: Reconceptions of the Intellectual, Cambridge University Apotheosis Society International Retreat, Buchnerhof: Mountains to Move Power, South Tyrol, Italy, EU, July 15.

Puaschunder, J.M. (2016). Intergenerational justice: Climate change burden sharing, Invited ‘Sustainability in Economics’ guest speaker, Oikos International Student Association, New York, New York, USA, April 28.

- Media Coverage, May 1, 2016